Gold Card Visa Fundamentals Explained

Table of ContentsAbout Gold Card VisaUnknown Facts About Gold Card VisaHow Gold Card Visa can Save You Time, Stress, and Money.The Buzz on Gold Card VisaHow Gold Card Visa can Save You Time, Stress, and Money.Facts About Gold Card Visa RevealedExcitement About Gold Card Visa

Such a guideline would certainly additionally be a separation from the current U.S. government tax laws which enforces a worldwide income tax obligation on united state residents and locals. Therefore, the program might draw in international people that may otherwise avoid the USA due to its aggressive tax reach. This brand-new action synchronized with one more significant modification in immigration policy.The announcement targets petitioners making use of the H1-B program for specialized line of work workers. The pronouncement adds that the limitation will end in 12 months if the President determines not to prolong it.

At the exact same time, the brand-new H-1B constraints underscore the Administration's readiness to reshape standard employment-based migration categories through economic barriers. Stakeholders must closely keep track of upcoming firm support, analyze tax implications, and get ready for both the chances and obstacles these policies existing as added info comes to be readily available. Proactive planning will be essential as the landscape of U.S

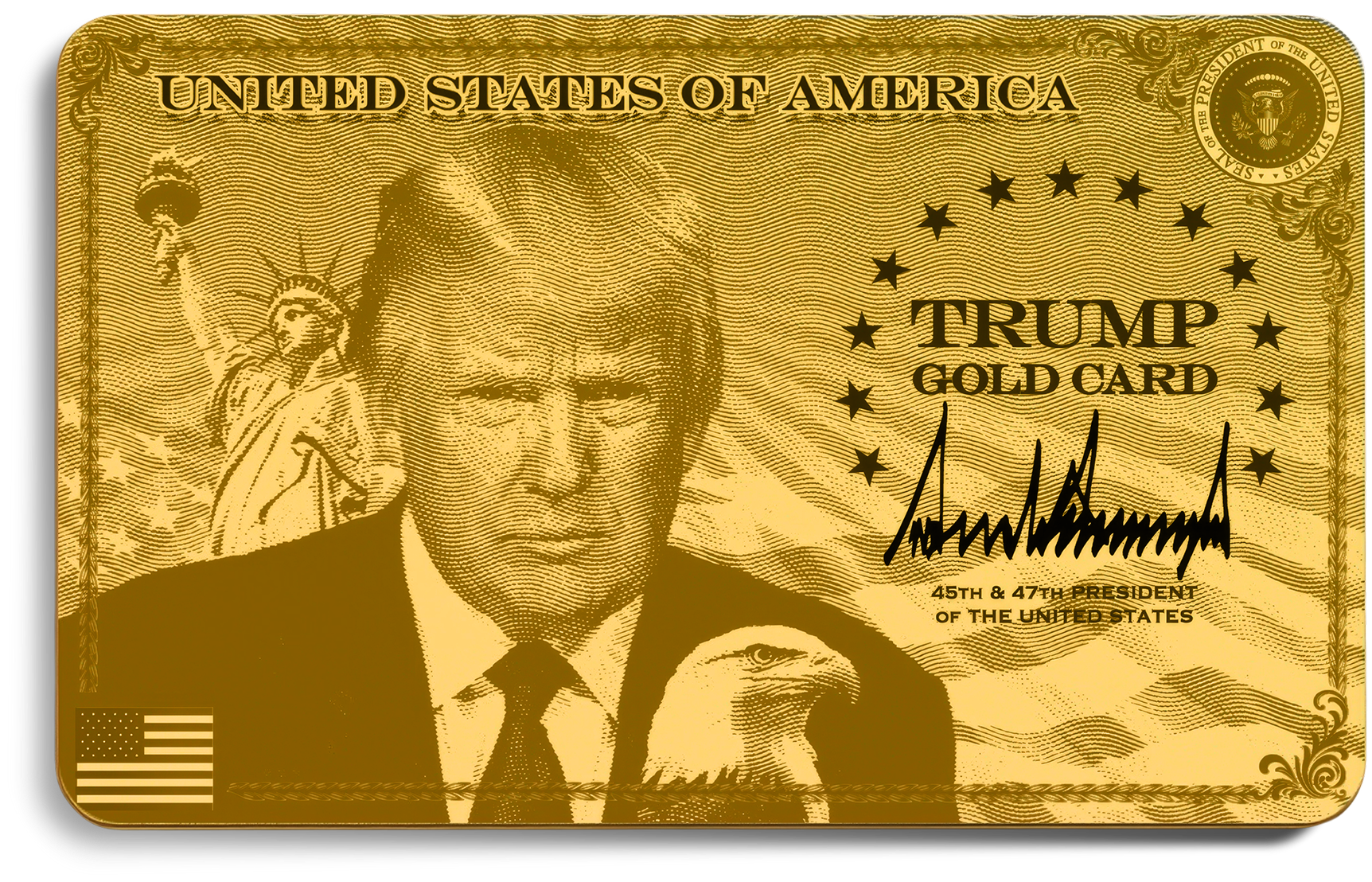

The "Gold Card": Analyzing the most recent Immigration Development In public comments on Tuesday February 26th, President Trump discussed a proposition for a brand-new type of united state visa, a "Gold Card". While the Head of state did not go right into details, he suggested that this brand-new visa might be provided to firms or to individuals for $5 million per card.

A Biased View of Gold Card Visa

The U.S. program differs as it is made to repay the U.S. debt as opposed to create tasks through financial investment. If this program comes to be regulation, it will certainly be one of the most expensive Golden Visa on the planet. There is a substantial tax benefit connected to this Gold Card proposition. Affluent international nationals often tend to stay clear of becoming united state

citizens to prevent united state taxes on their worldwide revenue. To draw in future Gold Card holders, the administration says the united state will certainly not exhaust them on their worldwide income, yet just on their united state earnings. This will offer Gold Card owners an advantage not provided to existing permanent homeowners or united state

It is uncertain if the idea is for this benefit to continue if they choose to become united state residents or is only readily available to those who stay in Gold Card status. We will certainly update this blog site as even more details emerge concerning this program.

Some Of Gold Card Visa

For the United States Gold Card to end up being a law, the proposal must pass your home of Representatives and the Senate to secure bipartisan support, which can be tough given its questionable nature. Firms like the US Citizenship and Immigration Services (USCIS) and the United States Division of Homeland Safety (DHS) will need to address concerns concerning national safety, identification checks, cash laundering, and the honest implications of the Gold Card visa holder.

US Consular Office and Consulates had actually provided more than one million non-immigrant visas, a practically 26 percent increase from 2023. This growth in worldwide engagement might create an appealing setting for the United States Gold Card visa in the future.

Especially, as we will go over later, it legal adjustments to implement a Gold Card visa have been ended one of the most recent spending plan proposals. Under this "strategy", the Gold Card program would give permanent residency in exchange for a minimal $5 million financial investment. Nevertheless, succeeding statements from the management have actually recommended that the EB-5 and Gold Card programs may exist side-by-side in some capability, potentially under the oversight of the Division of Commerce.

3 Easy Facts About Gold Card Visa Explained

The Head of state can not solitarily get rid of the EB-5 programthis needs an act of Congress. The EB-5 program was initially developed in 1990 and later on enhanced by the RIA in 2022. Given that it is ordered in the Immigration and Nationality Act (INA), any initiative to repeal or modify the program would require the passage of brand-new regulation through both chambers of Congress.

This results from the reality that, unlike various other migration bills that were not permitted to go via the budget costs procedure as changes, the intent behind the Gold Card is to directly minimize the shortage. Gold Card Visa. However, as of this article, no reference of the Gold Card or similar programs can be discovered in your house or Us senate propositions for the current budget.

Provided the intricacy of this procedure, any kind of adjustments to the EB-5 program would likely take months or also years to materialize. Historically, immigration-related legal modifications have faced substantial obstacles, calling for bipartisan support, economic justification, and lawful examination. Additionally, previous attempts to present considerable overhauls to the EB-5 programsuch as boosting financial investment limits or tightening local center regulationshave taken years to pass.

Under the EB-5 Reform and Honesty Act (RIA), the EB-5 Regional Center (RC) program is accredited via September 30, 2027. This means that unless Congress reverses, modifies, or replaces the program, it will remain in effect until that date. Better, Congress has actually particularly suggested financial investment quantities for EB-5 and that can not be changed by executive order or law.

Top Guidelines Of Gold Card Visa

If the Gold Card visa calls for a $5 million financial investment yet does not provide the exact same adaptability in task production criteria, it may negatively affect financial investment flow into particular sectors, potentially limiting opportunities for middle-market capitalists. Among the biggest arguments for maintaining the EB-5 visa is its tried and tested performance history in promoting the united state

By establishing the minimum investment threshold at $5 million, the U (Gold Card Visa).S. federal government might be: Targeting ultra-high-net-worth capitalists Aiming for bigger facilities financial investments Producing a structured path for international magnate However, enhancing the investment quantity might additionally value out many prospective investors, specifically those from emerging markets that might struggle to fulfill such a high financial threshold

Fascination About Gold Card Visa

His litigation efforts were instrumental in Shergill, et al. v. Mayorkas, a spots instance that brought about the U.S - Gold Card Visa. government identifying that under the INA, L-2 and E visa partners are licensed to work occurrence to their status, eliminating the need for different EAD applications. This case has actually transformed job consent for hundreds of families throughout the USA

By the authority vested in me as Head of state by the Constitution and the regulations of the United States of America, it is thus bought: Section 1. Objective. My Administration has worked non-stop to undo the disastrous immigration policies of the prior management. Those policies created a deluge of immigrants, without major factor to consider of exactly how those immigrants would impact America's interests.

The Gold Card. (a) The Secretary of Commerce, in sychronisation with the Secretary of State and the Assistant of Homeland Protection, shall establish a "Gold Card" program licensing an alien that makes an unlimited present to the Department of Commerce under 15 U.S.C. 1522 (or for whom a company or comparable entity makes such a present) to establish qualification for an immigrant visa using an expedited process, to the level regular with regulation and public safety and security and national security concerns.

(b) In settling visa applications, the Secretary of State and the Secretary of Homeland Safety and security shall, regular with appropriate legislation, treat the gift specified in subsection (a) of this section as evidence of eligibility under 8 U.S.C. 1153(b)( 1 )(A), of outstanding company capability and national advantage under 8 U.S.C. 1153(b)( 2 )(A), and of qualification for more info a national-interest waiver under 8 U.S.C.

Not known Facts About Gold Card Visa

(c) The Secretary of Business shall deposit the presents contributed under subsection (a) of this section in a different fund in the Department of the Treasury and utilize them to promote business and American sector, consistent with the statutory authorities of the Division of Commerce, see, e.g., 15 U.S.C. 1512.